What the Ceo Wants You to Know Cover

This is a summary of a great 🌳 tree book on the basics of business. This book is rather unusual because it acts as a condensed guide on business for employees looking to advance in their careers. Regardless, considering it is not a long volume, I recommend that you buy it for reference. Read more than about book classifications hither.

Ram Charan'southward What The CEO Wants You To Know contains a remarkably concise explanation of how a business concern works. It is incredible. It took me 5 years to truly grok some of these ideas; Charan takes all of that and squeezes it into a handful of chapters: a cool 100 pages in the paper edition.

Charan'southward book also plays into one of my longest-held biases: he thinks that an understanding of business basics is necessary for a good career. In my instance, I didn't have much of a choice: my career was heavily-weighted towards startups from the start. This meant that I had to evaluate potential employers as actual businesses, not just as places to find a task. I had to know if a company would be around in a yr, or three; I could non coast on brand-proper name recognition the way my friends could with larger companies.

Charan goes further, however: he argues that employees of all companies should have an appreciation of how their business works. If they practice and so, he writes:

People feel more connected to their piece of work and have greater job satisfaction when they really understand how their arrangement works. And as the company grows profitably twelvemonth after year in that location are greater opportunities for them to expand their careers and make more money, and the visitor tin make a greater contribution to the customs. (…) That's why the all-time CEOs everywhere piece of work so hard to explicate things. And that'southward why I want to share with you lot, in the words of the book'due south title, what the CEO wants you to know, then that you tin acquire, grow, and make a greater contribution to non only your system but the world effectually you.

This sounds a tad wishy-washy, but in that location are tactical advantages to this. In the past, nosotros've discussed how you can't ignore business models in your career. Understanding the fundamentals of business is but an extension of that idea: if we assume that incentives drive organisational behaviour, then agreement concern thinking is a surefire way to align your work with your visitor's underlying incentives. It's the sort of affair that should lead to better career outcomes over the long term.

The good news here is that there really isn't much to grok. Charan explains that every business is the same inside, and that there are actually just four principles that y'all must understand. These principles employ to fruit stands and noodle stalls; manufacturers and multinational service firms. They practice not require special knowledge to acquire.

This book summary focuses on these iv principles. At under 200 pages,What Your CEO Wants Y'all To Know isn't a very long book; Charan spends the 2nd part after the four principles on execution details — things like hiring well and creating process and putting the principles to practice. This second half is much weaker than the first half considering Charan has limited space for nuance. We're going to skip that entirely.

This is ok, I think: if yous want to learn business, you'd sympathise that nothing you tin read in a book beats actual feel. Charan's guide is merely the skeleton on which you may organise your learning. It was written with the beginner in heed.

Every Business Is The Same Inside

In every business the basic building blocks are e'er the same. This can exist boiled down into four parts:

- Satisfying customer needs better than the competition

- Generating cash

- Producing a sufficient return on invested capital

- Growing well

That's information technology. There's all in that location is. But Charan writes:

Most people know how to do one or two of those things actually well. True businesspeople understand all four parts individually too as the relationships between them. Businesspeople have an insatiable desire to cut through to the fundamental building blocks of moneymaking.

It'due south that final function that's central.

Everything about a business flows from a nucleus of customers, greenbacks generation, return on invested capital, and growth. This includes the piffling things that you — in your capacity every bit an individual employee — care almost, like promotions and hiring, product development and inventory management, employee compensation and marketing spend. If the four-office core is unhealthy, the company will eventually falter. Layoffs occur. Section budgets become cut. If your grasp of the four-part cadre is strong, you lot tin usually tell how y'all're going to exist afflicted before that happens.

The 4-part core can be translated into a series of questions:

- Is the business alluring and retaining customers?

- Does the concern generate cash? (Note how this question isn't 'is the concern profitable?'; we'll go into this in a bit)

- Is the business concern earning a adept return on the money invested in the business?

- Is the business growing? And if information technology is growing, is this good growth or bad growth?

Keep these questions in heed equally you read this summary. Ask yourself how they apply to the business you work in. And then piece of work out the second order implications on your career from those answers.

Principle ane: Customers

There's a Peter Drucker proverb that goes "the purpose of a business organisation is to create a customer." This is true: without a customer paying yous, you have no concern. So the first component of moneymaking is simply providing a service or offer a product that a customer will pay for.

Much of the startup literature is focused effectually this aspect of concern. We have Eric Reis'due south The Lean Startup, Clayton Christensen'southward Competing Confronting Luck, Geoffrey Moore's Crossing The Chasm and Steve Blank'due south The Four Steps to the Epiphany, all books that focus on the challenges of developing a product and bringing information technology to market place.

The core idea, however, is unproblematic: is your business concern able to attract customers against its competition? Why or why non? In society to sympathise this, you must understand why your customers are buying what you lot offer. Information technology may non be the physical product alone. They could be buying reliability, trustworthiness, convenience, or the customer experience. (This is sometimes known as the 'chore to be washed' framework for agreement business.)

An added wrinkle is that some businesses serve customers who are not consumers of their products. An example is P&G — which develops products for the household 'consumer' — simply serves stores similar Walmart and Target, who are their 'customers'. Many processes in P&Yard's business (such as logistics, discounts and merchandising) are thus geared towards retail stores instead of the end consumer.

This contraction doesn't change the basic principle, even so: proficient businesspeople know why their customers are buying their products and services. They know what levers become into their customers's purchasing decision. A fruit vendor looks at what his customers buy on a daily basis, and develops a experience for what fruits are popular and what are not. A multinational CEO (that Charan particularly admires) visits retail outlets to talk to customers, taking care to observe where they come from, what they buy, and where they go to after visiting the shop.

Skillful businesspeople practice this because many things stalk from the customer. When they tin can't go the prices and margins they used to, they know to talk to the customer to find out why.

This is easy to say only hard to do. Here's a personal story to illustrate this difficulty: I do content marketing work for a friend's SaaS company, on the side. The get-go stride in marketing is understanding why the customer purchases from your visitor. In one case you sympathise that, you know how to go later prospective customers. What I've learnt from my experience with this company is just how difficult information technology is to understand why a customer purchases you over your contest. It's easy to say "oh, but go talk to customers!", simply incredibly difficult to synthesise the qualitative experience of doing so; similar art, you can only know if you've tried.

Principle ii: Cash Generation

Greenbacks generation is the difference between all the cash that flows into the concern and all the greenbacks that flows out of a business organisation in a given time menstruum. Conventional business jargon calls it 'cash flow', but Charan prefers 'cash generation'. He says the latter phrase forces everyone to sympathise both parts of the concept: the money that flows in, and the money that flows out. I don't really care near Charan's distinction between the two names, but the thought is subtle and simple and important to grasp.

Cash flows into a business in the class of greenbacks, checks and credit cards for the auction of its products or services. Greenbacks flows out for things such as salaries, taxes and payments to suppliers. So far and so proficient. But a company with skillful cash generation is different from a company that is profitable. This nuance matters.

When you are a street vendor, you pay your suppliers in cash and you lot receive cash from your customers. In other words, your cash menstruum and your income are one and the same. Larger companies, nevertheless, may have customers who buy now but pay later (accounts receivable), and may themselves purchase production from suppliers now but pay later (accounts payable). In other words, companies may make a sale today and book information technology as income, but the real cash but arrives in their depository financial institution accounts a menses of fourth dimension afterward. The timing of these payments affects cash generation.

Businessperson Tren Griffin likes to quote Wu-Tang Clan's 'C.R.Eastward.A.One thousand', or 'Cash Rules Everything Around Me.' He repeats it as a mantra considering companies tin forget that cash is ultimately what matters in business organisation. Y'all can't pay salaries or taxes with accounting turn a profit, subsequently all. It has to be cash — or, as Method Man puts information technology, "CREAM become the money, dollar dollar pecker, y'all."

It seems odd that cash generation matters more than profit. But at some level this makes intuitive sense: unprofitable startups can proceed going for as long as they have money in the bank; assisting companies get into trouble when they don't accept enough cash and are unable to borrow. When that second scenario happens — call back Full general Motors in the 2008 crisis — they go broke.

(Conversely, companies can filibuster turning a profit if they have good cash generation. An exercise for the reader: how is it possible to run a company at an accounting loss with positive cash menstruation? What does this hateful in terms of a business playbook?)

I think one of the more hit greenbacks catamenia examples in the book is that of a management consultancy that was running out of money. The senior partners had borrowed heavily to buy the visitor, which meant a lot of cash every calendar month to make the interest payments. At 1 point, information technology was clear that they were going to run dry, and the simply choice seemed to be to sell off a piece of the business, which would diminish each partner's ownership pale.

Right before the deal was signed, even so, the CEO had an insight that saved the partners' share of the business. She realised that clients were paying on a xc-day payment term, instead of the 45-day industry average. This payment term meant that it took xc days on average from the time the firm sent an invoice to a client until the time it received the money.

So what did the CEO do? She changed the payment terms. She besides got partners to send invoices as projects progressed, instead of waiting for the cease of every month. These elementary tweaks inverse the cash situation of the business and allowed information technology to proceed running. Charan writes:

Greenbacks gives you the ability to stay in business concern. It is a company's oxygen supply. Lack of cash, a subtract in greenbacks, or increased consumption of cash spells trouble, even if the other elements of moneymaking — such every bit profit margin and growth — look good.

What Does Greenbacks Generation Have To Practise With You?

Charan takes pains to explain that everyone can contribute to their company's cash state of affairs. Information technology is piece of cake to remember that only the finance department is responsible for healthy cash menses, and y'all exercise whatever it is you lot were hired to practice. But nearly every action in a company either uses cash or generates cash, which means that simple tweaks to your work tin can lead to different outcomes for the visitor'southward cash generation:

- A sales rep who negotiates a thirty-24-hour interval payment term instead of a 45-24-hour interval payment term is greenbacks-wise. The company can get the money sooner and is able to put information technology to apply elsewhere.

- A factory manager whose poor scheduling results in excess inventory consumes greenbacks, because the company won't be able to free up that cash until the inventory is sold to customers.

- Fifty-fifty something every bit small as cashing checks affair: if yous procedure your mail in the afternoon instead of in the morning, you may cause a 2 24-hour interval filibuster on Fridays if the checks don't go cashed in time for the weekend. This is two actress days where the cash isn't in the company's coffers.

It'southward probably an interesting practice to ask yourself these questions:

- Is your visitor a cyberspace cash generator? Why, or why not?

- If your company isn't a net greenbacks generator, is it because direction is investing in growth, or you accept too much tied in inventory, or expenses are too high, or payment terms are too long, or your company has borrowed too much and is struggling with payments?

- Does your division generate cash? Why, or why not?

- A division may occasionally exist 'managed for cash, not growth' — meaning that the cash from the division is beingness used to fund other parts of the visitor. This could exist another department that's growing rapidly, or it could be R&D for a new line of business. Whichever it is, you should know, because information technology affects the incentives that govern your dominate's decisions.

Understanding Gross Margin

A fundamental role of agreement cash generation is understanding gross margins. The idea behind gross margin is simple: it is the amount of money you make minus the costs direct associated with making or buying it. These are things such as the toll of material used to create the products (toll of goods sold, or COGS), along with the straight labour costs. It doesn't include indirect costs associated with making the production — like toll of sales and general administration or distribution costs.

Gross margin is dissimilar from cyberspace profit margin — which is the amount the business makes later on paying off all its expenses (this includes COGS, but also fixed costs like rent and involvement payments and taxes).

The formula for calculating gross margin is easy: y'all take the full corporeality of acquirement your business organisation makes, subtract COGS from it, and and then carve up by revenue.

Gross margin tin be expressed as a total number, or as a percentage. Let'due south say that y'all're like Ram Charan, and you lot grew up with a family business — a shoe store — in Republic of india. If you sell 1000 pairs of shoes at $fifty a pair, your total sales is $50,000. Yous bought those shoes from your supplier for $30 a pair, meaning COGS is $30,000. Your gross margin is thus $50,000 - $30,000 = $twenty,000, or forty%.

Why is gross margin and then important? As with virtually things in this book, the number itself isn't as important equally the factors behind it. Your business concern's gross margin may be manipulated using a number of levers:

- The product mix — perhaps some of your products have higher margins than other products. Changing the mix changes the overall gross margin of your company.

- The client mix — perhaps some segment of your customers are less profitable compared to others. (For case, yous make a software production and have students as role of your user base). Cutting those out might change your overall gross margins.

- The distribution channel mix — as time goes on, sure distribution channels may become more expensive to employ. This affects your margins besides.

- The cost structure — is it getting more than expensive to produce your production? Why? What can you do differently if this is the case?

A good businessperson has an intuitive grasp of the factors that affect her business concern'due south gross margins. This in turn has an effect on the greenbacks generation of her business concern. All else being equal, declining gross margins usually mean a time to come with worse greenbacks generation. If the businessperson doesn't scout the commensurate cash outflows, things tin get very difficult very apace.

Principle iii: Render on Invested Capital

Gross margins pb us to the third principle in Ram Charan's iv-part nucleus. A business concern is a machine that takes in money on one end and turns it into more than coin on the other. The render that money makes is known as the render on invested capital.

The formula for ROIC is (again) easy: you lot accept your internet income and divide it by your business's total capital (your money plus any coin you have borrowed).

The higher your ROIC, the improve. Again, the formula for this metric isn't every bit important equally the thought backside it: imagine that your concern is a slot machine. Yous put one dollar in on one cease of the motorcar, and the machine spits out a certain amount of money — say, three dollars. Your ROIC is the multiple the machine gives yous — in this case, you lot have a multiple of three.

When it comes to gauging the health of a business, your ROIC calculation doesn't need to exist precise. What you really want to go at is a sense of the mensurate over time. Is your slot machine's ROIC number ameliorate than last year, or the year earlier that? Is it better than your competitors's? Is it where it should exist? And where is it headed?

Charan points out that for street vendors, ROIC is an intuitive concept. You either grasp it or you languish. Years ago, Charan brought a grouping of MBA students to an open-air market in Nicaragua. They approached a woman selling clothing in a modest shop, and asked her how she got the money to pay for her merchandise. This is what happened adjacent:

She said she borrowed information technology, paying 2.v pct interest a calendar month. 1 fast-thinking student did the math—2.5 percent multiplied by twelve months—and announced that the interest charge per unit was a whopping xxx percent a year. The woman gave me a disapproving expect and said in Spanish that the student was wrong. Compounded month to month, the rate was actually 34 percentage annually.How much margin did she brand? Only 10 percent. Then how could she survive borrowing money from loan sharks charging 34 pct a year? We had to enquire.

Annoyed by the stupidity of the question, she made several sweeping round motions through the air. Her gesture meant rotation—rotation of inventory, or turning the stock over. She knew intuitively that earning a practiced return had two ingredients—profit margin and velocity. If she sold a blouse for $10, she made just $ane in profit. To pay the involvement on the loan and to restock her cart, she had to sell her wares once more and again during the mean solar day. The more she sold, the more "ten percents" she accumulated.

'Velocity' is the term used to draw the thought of speed, turnover, and move. Imagine raw materials entering into a factory and turning into finished products, and then those finished products moving into stores, and and then flight off shelves to be used past the end consumer. How chop-chop does this occur? That is velocity.

Velocity may be calculated by taking your full sales for some product for, say, a year, divided by the value of that product. If you want to look at inventory velocity, separate total sales by total inventory. The number you end upwardly with is oft called 'inventory turn' — as in, "how many times does your inventory turn over in a year?" Walmart, for instance, has 360 inventory turns in toilet newspaper a year. That ways the entire inventory of toilet paper is sold out almost every day — allowing Walmart to recoup their cash forth with some profit each time that occurs. For Walmart, toilet paper is a great apply of shelf infinite and cash. (Practice for the reader: how would Walmart's cash generation be affected if it expands its product offering to include more than toilet paper?)

Once again, Charan stresses that the formula isn't every bit important every bit the concept of velocity itself. Ask yourself: in your company, how long does it take from the fourth dimension an order comes in to the time it is delivered to the customer? And if your concern holds inventory (like my quondam company did): how long is information technology earlier you have to resupply?

The reason velocity matters is because it contributes straight to the return you make in the business. This is expressed with a formula that represents a 'universal truth in business': basically, that your return is simply your profit margin multiplied by velocity. This is expressed like so:

Render (R, expressed as %) = Margin (M) × Velocity (V)

Charan points out that many people focus on turn a profit margins alone. The best businesspeople — the ones 'who will exist promoted' — focus on velocity too. He continues:

Velocity is important to every company. Consider companies that take a lot of "stock-still" assets—factories, mechanism, or buildings. Have, for example, AT&T. It has a huge investment in wires, cables, satellites, and microwave towers. With prices for long-altitude vocalism calls falling due to decreased need (know whatever higher pupil with a landline in her dorm room?) and margins shrinking in its cellular business organization (thanks in large part to the intense competition), the only mode to improve the return on its invested capital is to focus on velocity.How? By offering cell service, Internet, and television through its network.

A particularly fun exercise is to expect at how velocity is expressed in other types of businesses. Have a recent episode of Planet Money titled The Problem With Table 101. The episode examines the nature of the restaurant business concern in New York — specifically, the relationship between average check size for a table and the amount of time people spend at said tabular array. The shorter the amount of fourth dimension, the more than people pass through the restaurant — and the more orders the restaurant tin serve (velocity). Conversely, the larger the check size, the higher the profit margin. But here's the rub: yous demand a residuum betwixt the 2. Too lilliputian time at a table results in decreased bank check size (and therefore profits); too long and you have low velocity. The rest of the episode examines the levers that go into this balancing decision, every bit experienced through the eyes of one extremely pop eating house in New York.

Velocity and margin are specially important to a business concern, because they are the two levers that virtually directly influence a visitor'due south returns. Charan underscores this importance past explaining that but earning a return is non enough. In truth, returns must clear the 'price of upper-case letter', or bad things volition happen in the business organization.

The cost of capital is the cost of using your own or other peoples'south (banks'south and shareholders's) money. This cost is normally dependent on the prevailing interest rate — and at that place are many ways to calculate it which I won't get into. The important idea here, however, is that if ROIC fails to exceed the cost of capital, there volition be existent upset amidst investors in the company, considering it means that management is destroying shareholder wealth. (Why should they invest money into your business concern if they can make more past putting it into a Treasury bond?)

All companies will eventually accept to do something nigh businesses, divisions, or product lines they ain that do not earn higher up the toll of invested capital. They volition either take to sell off (divest) the concern or discontinue the product line. Charan closes off this section with the following piece:

You can help make a difference by suggesting ways to ameliorate the return. If, for instance, you work for an automobile company, you'll detect the return on pocket-size cars is problematic. Auto manufacturers effectually the globe accept been earning less than a 2 percent return on them, which is less than the cost of uppercase. How might that part of the business generate a higher return? Or if you work at a software company, think once again about the formula for return on invested upper-case letter, where ROIC = cyberspace income divided by full invested capital. Considering (in a software company) the denominator is so small-scale, any way you can figure out to boost cyberspace income tin can accept a big issue.

Principle 4: Adept Growth

ROIC brings us to the next and terminal principle in the nucleus of concern: growth.

Charan makes a rather controversial assertion in the introduction to this section: if your company isn't growing, then it is dying. The argument goes something like this: in a world that grows every day, a visitor that is standing still or doing 'just fine' is falling backside. A company that is overtaken by a competitor somewhen gets boxed in. It loses many of its advantages over time. Charan's conclusion: growth is imperative to business.

This assertion isn't true for all industries, nor is it true at every company size. SMEs, for instance, seem to become along only fine at a certain size, fifty-fifty if they are constrained by factors exterior their command.

Just Charan also makes a more than pragmatic, less controversial argument: the growth of a company enables one'southward career growth. This is mutual sense:

If the visitor is not growing profitably or your business unit lags behind competitors, your personal progress will suffer. You will not take the opportunity to be promoted and motion forward. Summit managers will brainstorm to cut costs and reduce the number of employees. They'll start reining in R&D and advertizement. Expert people will get out, and eventually the company will go into a death spiral and employees—including you—will endure.

On the flip side, however, some companies grow themselves to death. Charan gives us three stories to illustrate this fact, but whatever reasonably curious observer of business would have noticed like stories. Hither's story i, a common tale of using leverage to fund growth:

Many entrepreneurs taste success on a pocket-size scale and go obsessed with growth, losing sight of the moneymaking basics along the mode. Unfortunately, the case of one entrepreneur who served restaurants is typical. He built a profitable business organization installing beverage equipment at a toll of $2,000 per installation and thereafter collecting $100 a month from the eating house for the ingredients he supplied.So far and then good. But he borrowed money to make the installations, and the margin on the ingredients was so slim that it did not encompass the interest payments. All the same he was obsessed with growth and kept installing his equipment in more and more restaurants. The outflow of cash soon outpaced the flow of money into the business organization, and the lenders decided that the company needed a new CEO.

Story two, which is a story most bad sales incentives:

Sometimes senior direction inadvertently encourages unprofitable growth by giving the sales force the incorrect incentives. For instance, one $sixteen million injection moulding company rewarded its sales reps based on how many dollars' worth of plastic caps they sold; they were not accountable for profits. Everyone was excited when the company landed $four meg of new sales from ii major customers, but these big contracts were on slim margins, not plenty to generate the cash needed to fund the sales.

And story three, on the perils of triggering a price war:

To rev up its business concern in an important unit, a global edifice company brought in a new sectionalization caput. He was the heir apparent to the CEO of the parent visitor and his new assignment was a major test to see if he was ready for the acme job.The new manager believed he could gain pregnant market share by cut prices. He was successful—at get-go. Sales grew over the adjacent iii months, and so did the unit's share of the market.

However, the competition responded in kind. Desperate to preserve their market shares to comprehend their loftier fixed costs, competitors likewise cut their prices. The end event? All the cost cutting caused revenues, profits, and greenbacks generation to compress throughout the industry, hurting Global Building along with everyone else.

Those of you who are ardent students of concern would have probably come across like stories. These aren't unusual by any means. Good businesses dice all the time in the pursuit of bad growth. There is something about the shininess of growth itself that cause many businesspeople to forget the unproblematic principles of this department.

Then what, and so, is proficient growth? Charan proposes that good growth is profitable, organic, differentiated, and sustainable:

- Assisting. Good growth not only generates profits but is also uppercase efficient. It needs to earn an amount greater than the company would receive by investing its money into something ultra-safe like a Treasury bill.

- Organic. Good growth nigh always flows out of the company's existing capabilities. A corollary: a company'due south job is to systematically expand its set of capabilities.

- Differentiated. Charan writes "you lot never want to provide a product or service that is seen equally a commodity. Customers must prefer information technology. Otherwise, y'all will never brand very much money". A more nuanced take on this is that the growth must be defensible — and a differentiated product offering is merely one defensible strategy. There are others.

- Sustainable. Growth should continue year after yr, instead of providing a quick spike in revenue. Growth that triggers a toll war is past definition not sustainable.

In the terminate, the ultimate measure of growth are the metrics that nosotros've covered before — cash generation, in particular. Retrieve Tren Griffin's mantra: 'greenbacks rules everything around me'. If sales is growing but cash isn't, take a step dorsum to figure out why. Are profit margins shrinking? If you sell to other businesses, are your current payment terms too loose? Has your customer mix changed, changing your product mix and your gross margins along with them?

Often, businesses must spend money and have a temporary hit in cash generation in order to grow. Manufacturing companies come to listen: they must pay for raw materials and — if expanding — cough out coin to build out additional manufacturing plant capacity. But subscription-based business models also suffer from similar dynamics. In subscription-based businesses, a visitor spends a certain corporeality of coin to acquire a new customer. That client then pays a small amount of coin each month for the production or service. If it costs $500 to acquire a customer and the customer pays $100 a month, then it volition take five months to recoup the price of acquiring that customer. This is know as the payback period. SaaS companies that are growing will thus suffer from what is known as the 'SaaS cash trough': that is, they will have a severe cash problem until all the new companies they've just acquired hit their payback period.

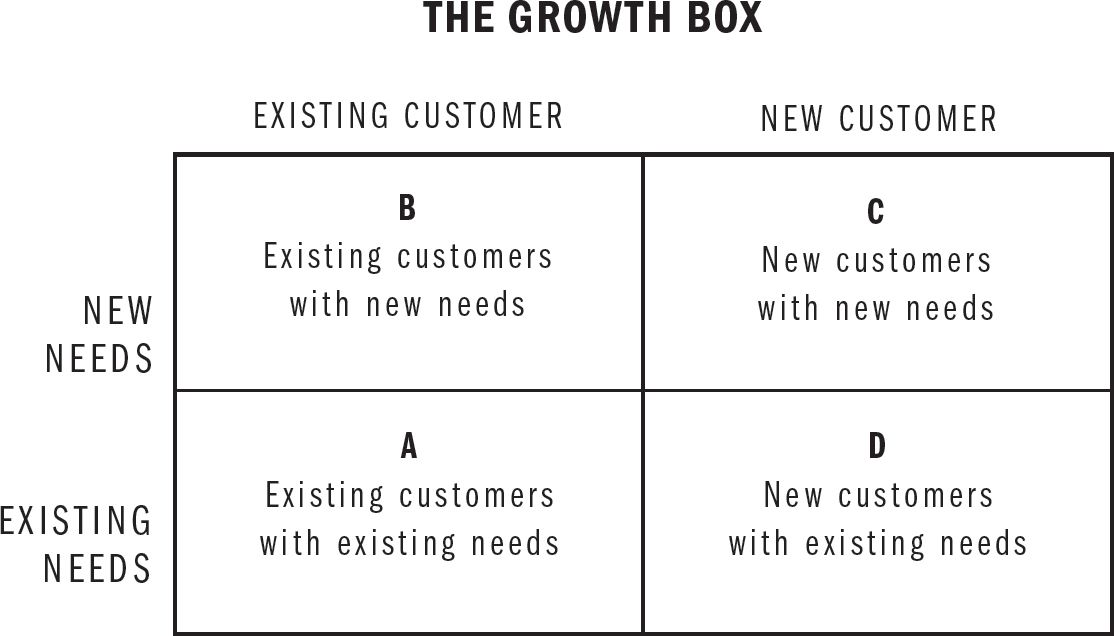

Understanding the backdrop of expert growth is often what is elementary. The more difficult chip is in finding opportunities for good growth. Charan gives us the typical business schoolhouse growth box:

He then suggests that thinking well-nigh the iv quadrants tin trigger ideas for growth. But make no error: pursuing growth is an art. It's 1 of those things that come from practice and observation, not from the avid study of frameworks. Charan can help explain what expert growth looks like, and warn yous against the dangers of growth for growth's sake, but the practice of finding and executing on growth opportunities falls squarely on the shoulders of the business practitioner.

Conclusion

So let's wrap upwardly. What The CEO Wants You To Know is a fantastic volume — curt, to the point, and with a bang-up formulation of the basic principles of business concern.

My central thesis with this summary is that even a rudimentary understanding of business organisation nuts helps you in your career — regardless of what industry yous're in, what level you lot're operating at, and the specific part you play in your company. Charan spends most of the book tying these principles back to the individual employee, helpfully providing questions and examples that span the business organization world. Only I think these implications should be worked out according to your own situation. Ask yourself:

- Why does your business organization's customers buy from your visitor? Why aren't they buying from other competitors? More importantly, does your company know these reasons? If they do not, can yous find out?

- What is the cash generation situation of your company? A company that is profitable might not have good cash flow; conversely, a company that isn't profitable today may take good cash generation — or at least, skillful greenbacks generation downward the route. The question you should be asking is if management understands the nuances of cash generation, and thinks well-nigh it like a businessperson does. This usually takes the class of two parts: first, empathize the incoming cash flows and outgoing cash flows of your visitor. 2d, analyse the actions that your company takes. Are its actions consequent with the cash situation you've uncovered in the starting time office? This tells you lot something near management'due south understanding of cash generation. (This is specially important if you lot're working at a startup, where management can be as clueless as a bull in a china shop.)

- Is the ROIC of your company going up? More importantly, does direction understand the concept of ROIC? If so, what are they doing most it?

- Is your sectionalisation or company managed for cash or growth? If it's being managed for growth, is that growth assisting, organic, defensible, and sustainable? Oft, these analyses can be adamant from hard metrics. Other times, they demand subjective judgment. If they demand subjective judgment, how do you know that your judgment is correct?

I like Charan'due south four-function nucleus because it is simple and easy to remember. It helped me organise my experiences in a coherent manner. Depending on where y'all are in your exposure to business, it might take yous a flake of time to integrate into your own experiences. But ultimately, I call back you'll detect that it isn't very complicated.

Consider this book my commencement book recommendation of 2020. It's great.

Source: https://commoncog.com/blog/what-the-ceo-wants-you-to-know/

0 Response to "What the Ceo Wants You to Know Cover"

Post a Comment